Tutustu liiketoimintayksiköidemme liimateknologiat ja Henkel Adhesive Technologies ja Henkel Consumer Brands.

4.3.2024

Henkel delivers very strong organic sales growth and significant earnings improvement in 2023

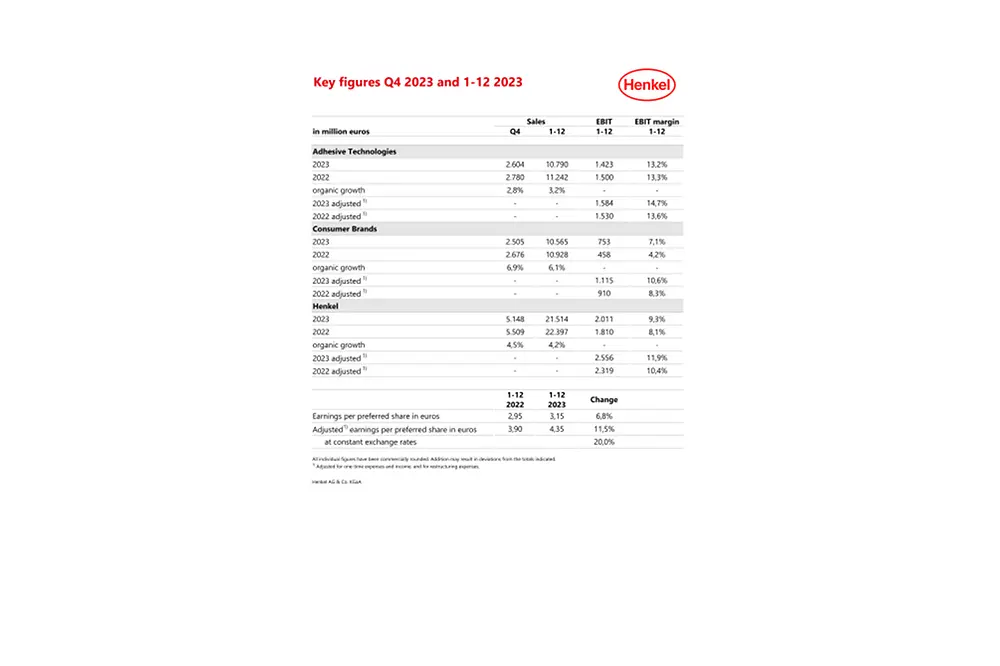

- Strong business performance in 2023

- Sales: 21.5 billion euros, very strong organic growth of 4.2 percent

- Operating profit (EBIT)*: 2.6 billion euros, significant increase of 10.2 percent

- EBIT margin*: 11.9 percent, strong improvement by 150 basis points

- Earnings per preferred share (EPS)* significantly higher: 4.35 euros, +20.0 percent at constant exchange rates

- Free cash flow at a new high of 2.6 billion euros

- Stable dividend proposed: 1.85 euros per preferred share

- Implementation of Purposeful Growth Agenda further accelerated

- Consumer Brands: Merger progressing faster than planned

- Adhesive Technologies: New organization even more customer-focused

- Both business units strengthened with targeted acquisitions

- Sustainability driven forward in key areas

- Outlook for fiscal 2024 – focus on profitable growth

- Organic sales growth: 2.0 to 4.0 percent

- EBIT margin*: 12.0 to 13.5 percent

- Earnings per preferred share (EPS)*: Increase of +5 to +20 percent (at constant exchange rates)

“Despite a persistently challenging market environment, we consistently drove our growth strategy forward in 2023 and even accelerated its implementation. We delivered very strong organic sales growth and significantly improved profitability. By that, we exceeded the outlook made at the beginning of the year. This successful development was driven by both Adhesive Technologies and Consumer Brands,” said Henkel CEO Carsten Knobel.

“We have also made faster progress than initially planned with the merger of the two former consumer businesses, Laundry & Home Care and Beauty Care, to form the new Consumer Brands business unit. The savings from the integration and the continued portfolio measures also contributed to the strong business performance of the business unit. In the Adhesive Technologies business, we have aligned our organization even more closely to our customers under a new management. We have increased sales organically and significantly improved earnings in a generally volatile industrial environment. In addition, we have further strengthened both business units through targeted acquisitions. Based on this performance and in line with our dividend policy, we will propose a stable dividend to our shareholders at the Annual General Meeting.”

“I would like to sincerely thank all Henkel employees for their teamwork and dedication which enabled us to navigate our company through these challenging times. Together as a strong global team we managed to successfully drive our Purposeful Growth Agenda forward, delivered tangible progress across all our strategic priorities, and developed our businesses. This makes me proud and very confident for our future.”

Group sales and earnings performance in fiscal 2023

Henkel Group sales reached 21,514 million euros in fiscal 2023, a nominal decrease of -3.9 percent compared to the prior year. Foreign exchange effects negatively impacted the sales development by -4.3 percent. At -3.9 percent, acquisitions/divestments had a negative impact on sales, which was mainly due to the divestment of the business activities in Russia. Organic sales growth was very strong at 4.2 percent. This development was driven by a price increase in the high single-digit percentage range, while volumes declined. In the second half of the year, however, there was a clear sequential improvement in the volume development.

The Adhesive Technologies business unit generated strong organic sales growth of 3.2 percent, which was driven by the business areas Mobility & Electronics, as well as Craftsmen, Construction & Professional. The Consumer Brands business unit achieved very strong organic sales growth of 6.1 percent, driven particularly by the Laundry & Home Care and Hair business areas.

Adjusted operating profit (adjusted EBIT) significantly increased by 10.2 percent to 2,556 million euros (previous year: 2,319 million euros). Positive selling price developments, ongoing measures to reduce costs and enhance production and supply chain efficiency, and portfolio optimization measures more than offset negative impacts on Group profitability from continued high prices for direct materials and logistics.

Adjusted return on sales (adjusted EBIT margin) in fiscal 2023 was significantly higher year on year at 11.9 percent (2022: 10.4 percent).

Adjusted earnings per preferred share also increased significantly by 11.5 percent to 4.35 euros (previous year: 3.90 euros). At constant exchange rates, adjusted earnings per preferred share increased by 20.0 percent.

Net working capital as a percentage of sales amounted to 2.6 percent, thus coming in substantially lower than the prior-year level (2022: 4.5 percent) particularly due to lower inventories.

Free cash flow reached a new high of 2,603 million euros, representing a significant increase compared to the previous year (2022: 653 million euros). This was due to much higher cash flow from operating activities resulting from higher operating profit and lower net working capital.

As a result, the net financial position improved significantly to 12 million euros (December 31, 2022: -1,267 million euros).

The Management Board, Supervisory Board and Shareholders’ Committee will propose to the Annual General Meeting on April 22, 2024, an unchanged dividend compared to the previous year of 1.85 euros per preferred share and 1.83 euros per ordinary share. This equates to a payout ratio of 42.4 percent, slightly above the target bandwidth of 30 to 40 percent. This payout is possible thanks to the strong financial base and the positive development of the net financial position of the Henkel Group. This ensures dividend continuity for shareholders.

Business unit performance in fiscal 2023

In fiscal 2023, sales of the Adhesive Technologies business unit reached 10,790 million euros and was thus – due to negative foreign exchange effects – nominally -4.0 percent below the previous year’s level. Organically, sales increased by 3.2 percent. This sales growth was driven by a very strong price development compared to prior year. Volumes declined overall, mainly due to demand remaining muted in some key end markets. As the year progressed, volume development showed a sequential recovery, recording a stable level in the fourth quarter. At 1,584 million euros, the adjusted operating profit was slightly above the previous year’s level. The adjusted return on sales increased by 110 basis points compared to the previous year and reached 14.7 percent. The significant increase in margin was driven mainly by higher prices combined with measures to reduce costs and increase efficiency in order to continue offsetting persistently elevated material prices.

Sales in the Consumer Brands business unit totaled 10,565 million euros in fiscal 2023 and was thus -3.3 percent below the prior year in nominal terms. Foreign exchange effects reduced sales by -4.4 percent. Acquisitions/divestments also had a negative impact of -5.1 percent on sales, mainly due to the sale of the business activities in Russia. Organically, sales increased by 6.1 percent. This sales growth was driven by double-digit price increases, while volumes declined partially due to continued portfolio optimization measures. However, volume development did show a significant sequential improvement in the second half of the year. Adjusted operating profit reached 1,115 million euros, a significant increase versus the prior year (910 million euros). This increase was driven by higher selling prices to offset persistently high prices for direct materials, by ongoing measures to reduce costs and enhance production and supply chain efficiency, by savings generated from the integrated Consumer Brands business unit and by portfolio optimization measures. At the same time, marketing and advertising investments were increased versus prior year to strengthen brands and businesses. Adjusted return on sales reached 10.6 percent, representing an increase of 220 basis points compared to the previous year – despite lacking the positive contribution to earnings from the business activities in Russia, which were divested in April 2023.

Outlook 2024

Moderate growth in global economic output is expected for 2024. This assumes a moderate increase in both industrial demand and consumer demand in key areas of the consumer goods business for Henkel. According to current estimates, global inflation is forecasted to be lower in fiscal 2024 than in the previous year, although it will remain at a high level overall. In addition, interest rates are expected to remain higher than in previous years.

Henkel expects the translation of sales in foreign currencies to have a negative impact in the mid-single-digit percentage range. Prices for direct materials are expected to remain flat versus the annual average for 2023.

Considering these assumptions, Henkel expects to generate organic sales growth of between 2.0 and 4.0 percent in fiscal 2024, with both business units anticipated within this range. Adjusted return on sales (adjusted EBIT margin) is expected in the range of 12.0 to 13.5 percent. Adjusted return on sales is expected to be between 15.0 and 16.5 percent for Adhesive Technologies and between 11.0 and 12.5 percent for Consumer Brands. For adjusted earnings per preferred share (EPS) at constant exchange rates, Henkel expects an increase in the range of +5.0 to +20.0 percent.

Significant progress across all strategic priorities

In a challenging macroeconomic and geopolitical environment, the company was consistently developed further in the past financial year. The strategic framework for purposeful growth was implemented at an even faster pace. Over the last four years, Henkel has changed fundamentally in many dimensions: structure, team, and culture. And these changes show tangible results. Three major projects in particular had a significant impact on the past year and were successfully executed – and have substantially advanced the transformation of Henkel.

Sale of the business in Russia

In April 2022, just a few weeks after Russia’s attack on Ukraine, Henkel took the decision to exit its activities in Russia. This was followed by a highly complex divestment process. In April 2023, Henkel was finally able to sell its business in Russia to a consortium of local financial investors. The agreed purchase price amounted to around 600 million euros.

Consumer Brands: Merger progressing faster than planned

With the merger of the two former consumer businesses, Laundry & Home Care and Beauty Care, creating the new Consumer Brands business unit, Henkel has brought all consumer brands across all categories under a single roof, including iconic brands such as Persil or Schwarzkopf, as well as the successful hair salon business. By that Henkel has established a multi-category platform to enable dynamic growth. In January 2023, the new business unit went ‘live‘.

And the new organization shows successes: Since then, Henkel has delivered on or exceeded key metrics and financial targets in the Consumer Brands business, for example achieving very strong organic growth and returning to a double-digit adjusted EBIT margin. At the same time, the integration process progressed much faster than originally planned. This is reflected in the savings that have been realized in 2023. More than 200 million euros of the targeted savings of around 250 million euros by the end of 2024 had already been achieved by the end of 2023. The targeted total savings from phase 1 were also increased to 275 million euros.

The second integration phase, which focuses on optimizing the supply chain network in the Consumer Brands business, has also been launched. In addition, the so-called “1-1-1 principle” has already been introduced in first countries. This means: one order, one delivery, one invoice. In 2023, savings of about 80 million euros were already achieved from phase 2 of the integration. The expected total savings from phase 2 were also increased from at least 150 million euros to around 250 million euros. The expected total savings from both phases of the integration, which are to be realized in full swing by the end of 2026, will therefore increase from 400 million euros to 525 million euros.

At the same time, Henkel has invested in its businesses to further strengthen its brands and innovation, for example by significantly increasing marketing and sales investments to fuel future growth and further improve profitability of the business.

Further development of the Adhesive Technologies business unit

To further leverage the globally leading market position and to take this business to the next level, Henkel made several changes at the top management level of Adhesive Technologies, promoting a more diverse and international team in fiscal 2023. At the same time, the organizational set-up was optimized to further enhance the customer and market proximity. The new structure comprises three business areas: Mobility & Electronics, Packaging & Consumer Goods, and Consumer, Craftsmen & Professional. It was established in the course of 2023 and is fully reflected in the financial reporting.

Further progress across all strategic priorities

Henkel continued to systematically implement its growth strategy in the past fiscal year and made important progress in all areas. The company further developed its business and brand portfolio, strengthened its competitive edge in the areas of innovation, sustainability, and digitalization, optimized its operating models and strengthened its corporate culture.

As part of its active portfolio management and in addition to discontinuing or divesting activities, Henkel has further developed its portfolio through acquisitions. In its Consumer Brands business, Henkel divested or discontinued brands and activities representing total sales of around 650 million euros following the announcement to merge the two consumer businesses in early 2022. For example, the North American air freshener business was divested in 2023. At the same time, the portfolio was strengthened with the acquisition of the sustainable laundry and home care brand Earthwise in New Zealand. In the Adhesive Technologies business unit, Henkel expanded its portfolio in the area of maintenance, repair and overhaul with the acquisition of Critica Infrastructure, a specialized provider of innovative fiber-composite solutions for repairs in a wide range of industrial applications. With this transaction, Henkel has added an attractive adjacent business to its adhesives portfolio and created a platform for further growth. The strengthening of both business units through targeted acquisitions continued at the beginning of 2024 with the acquisitions of the hair care brand Vidal Sassoon in China and Seal for Life in the area of industrial maintenance.

In 2023, Henkel launched numerous innovations onto the market, addressing important trends and creating value for customers and consumers. In the Adhesive Technologies business, Henkel introduced a new solution for bonding camera lenses in driver assistance systems. This enables fast and robust camera production in the automotive industry while ensuring greater safety in the next generation of autonomous vehicles. In the Consumer Brands business, Persil Deep Clean was launched in over 30 countries, introducing a new formula with an innovative enzyme technology. It provides excellent stain removal, while at the same time preventing unpleasant odors in the washing machine. Henkel also relaunched its entire Got2b styling portfolio with a new packaging design and improved sustainability with vegan formulas, natural ingredients and more sustainable packaging.

In addition, Henkel further anchored sustainability in the business. In this context, climate protection is one important pillar of Henkel’s “2030+ Sustainability Ambition Framework”, which has been continued to be strengthened across the entire value chain in the business. A particular focus is on expanding the use of renewable energies and driving progress toward the ambition of achieving climate-positive operations by 2030. Here, Henkel made significant progress. The company converted 14 sites to CO2-neutral production in 2023. By the end of 2023, Henkel achieved a reduction in CO2 emissions of 61 percent per ton of product (compared to the base year 2010). As part of the company’s sustainability efforts, Henkel also put an emphasis on a more sustainable product portfolio, for example through the increased use of renewable and recycled materials and is tracking its progress in this area more systematically.

Henkel has also made further progress in the area of digitalization. In its digital unit “Henkel dx”, the company continued to optimize internal structures, strengthened the development of digital expertise and further promoted a culture of innovation. Henkel has also deepened its strategic partnerships with globally leading digital companies such as SAP, Microsoft and Adobe. These enable Henkel to integrate cutting-edge technology into its digital platforms and projects. By accelerating digital innovations, a consistent platform strategy and by close collaboration between all business units and functions, the company was able to further improve IT efficiency last year and create new business opportunities for the company, for example in the area of business-to-business marketplaces.

In addition, Henkel further strengthened its company culture in the past year, based on the corporate purpose “Pioneers at heart for the good of generations” and the established “Leadership Commitments”. Another focus area was the implementation of the holistic “Smart Work” concept, which forms the global framework for topics such as mobile working, the digital workplace and employee health, as well as new global ”Diversity, Equity & Inclusion (DEI)” initiatives.

“We delivered a strong business performance in 2023, consistently implemented our agenda for purposeful growth in all strategic dimensions and drove forward the transformation of our company. I am firmly convinced that we are well on track and pursuing the right strategy. We can look toward 2024 and the following years with great confidence and are fully committed to delivering on our ambitions,” Carsten Knobel summarized.

* Adjusted for one-time expenses and income, and for restructuring expenses.

This document contains statements referring to future business development, financial performance and other events or developments of future relevance for Henkel that may constitute forward-looking statements. Statements with respect to the future are characterized by the use of words such as expect, intend, plan, anticipate, believe, estimate, and similar terms. Such statements are based on current estimates and assumptions made by the corporate management of Henkel AG & Co. KGaA. These statements are not to be understood as in any way guaranteeing that those expectations will turn out to be accurate. Future performance and results actually achieved by Henkel AG & Co. KGaA and its affiliated companies depend on a number of risks and uncertainties and may therefore differ materially (both positively and negatively) from the forward-looking statements. Many of these factors are outside Henkel’s control and cannot be accurately estimated in advance, such as the future economic environment and the actions of competitors and others involved in the marketplace. Henkel neither plans nor undertakes to update forward-looking statements.

This document includes supplemental financial indicators that are not clearly defined in the applicable financial reporting framework and that are or may be alternative performance measures. These supplemental financial indicators should not be viewed in isolation or as alternatives to measures of Henkel’s net assets and financial position or results of operations as presented in accordance with the applicable financial reporting framework in its Consolidated Financial Statements. Other companies that report or describe similarly titled alternative performance measures may calculate them differently.

This document has been issued for information purposes only and is not intended to constitute an investment advice or an offer to sell, or a solicitation of an offer to buy, any securities.